Analysis and Recommendations on UK Student Debt and Interest Payments

–

Challenges, Current Situation, and Potential Reforms

–

The issue of student debt in the UK has become both a financial and political challenge, with implications not only for graduates, but for the national balance sheet and future taxpayers as well. Recent figures and trends underscore the mounting scale of the problem.

–

The Scale of the Challenge

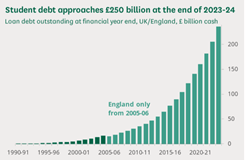

Adjusting for average inflation at 2.5% over recent years, the total cost of the student loan programme now exceeds £250 billion in today’s money.

–

–

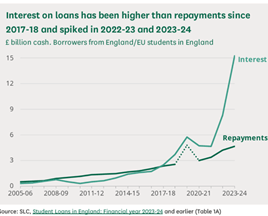

Higher interest rates, particularly those implemented from September 2022, have sharply increased the burden of student debt. Interest added to outstanding loans soared to £8.3 billion and £15.3 billion in 2023-24 alone. In the latest year, the interest capitalised on student debt was three times the value of repayments made—demonstrating how repayments are failing to keep pace with even the cost of borrowing, let alone reducing the principal.-

–

–

By the min 2040’s, the government estimates this to rise to over £500 billion in today’s money. The truth that be simply taking an adjustment of 2,5% inflation, the tru figure will be in excess of £800 billion and I would expect this to be £1 trillion.

–

Government Accounting and Debt Structure

–

Current government accounting methods do not show the full scale of student loan costs within annual expenditure figures. Instead, these liabilities are largely kept off the balance sheet, appearing instead as a growing component of government debt and accruing interest payments.

–

As of now, out of the UK’s £2,800 billion national debt, approximately £266 billion—or nearly 10%—is attributable to student loans. This means the annual interest on student debt alone is close to £10 billion (based on a 10% share of a £105 billion interest bill). Crucially, the total repayments from former students do not cover even this interest, let alone reduce the outstanding capital.

Long-Term Concerns

–

This imbalance raises serious questions about the sustainability of the system. With current interest rates and repayment levels, a significant number of borrowers will never fully repay their loans. Inevitably, a large portion of this debt may have to be written off or absorbed by taxpayers in future—i.e. the very taxpayers who may have taken out student loans themselves.

–

Proposed Solutions

–

- Lower Student Loan Interest Rates: Align student loan rates with the Bank of England (BoE) base rate and retroactively recalculate past interest charges. Charging higher rates than the government itself can borrow at is neither fair nor economically rational.

- Make Extra Payments Tax-Deductible: Allow any voluntary extra repayments to be deducted from taxable income. This would incentivise early repayment, especially among higher earners, and could, with a 50% take-up rate, add £5–10 billion annually to debt reduction efforts.

- Simplify Earnings Thresholds: Introduce a uniform minimum earnings threshold of £25,000 for all borrowers, replacing the current array of thresholds which complicate repayment planning and administration.

–

Assumptions and Next Steps

–

This analysis is based on available public data, with some necessary assumptions regarding the average outstanding loan size and average age of borrowers. These figures will be refined as more information becomes available.

–

Conclusion

–

The current UK student loan system is unsustainable under present conditions. Without reform, the rising tide of student debt will eventually return to the public purse, impacting not just graduates but the entire taxpaying population. The proposed measures offer a starting point for meaningful change, with the aim of building a fairer and more financially robust system for future generations.

Feedback and further suggestions are welcome—this is an issue that demands urgent and informed public debate.

–

Leave a comment