Labour’s proposed ‘BRIT Card’ aims to establish a mandatory digital ID for UK workers to combat illegal employment and immigration. However, concerns about costs, privacy, and effectiveness undermine public trust. Alternatives, such as enhancing the national insurance system and targeted enforcement, may offer more efficient solutions without significant disruption or expense.-

-Analysing the Merits, Risks, and Alternatives to Mandatory Digital ID Cards

–

Introduction: Labour’s BRIT Card and Its Stated Aims

–

Recently, Labour leader Keir Starmer announced plans for a mandatory ‘BRIT Card’ identity card, intended to curb illegal working and deter illegal immigration. This digital ID would become a prerequisite for lawful employment in the UK, forming the centrepiece of Labour’s efforts to demonstrate robust control over the labour market and immigration system.

–

While the government suggests that the proposal seeks to address long-standing concerns over illegal employment, the public are not convinced.

–

Furthermore, there is significant questions regarding cost, effectiveness, privacy, and the necessity of a new ID system and what is the true purpose.

–

Current Identification Landscape in the UK

–

At present, individuals in the UK can prove their identity and right to work using a variety of documents: passports, driving licences, biometric residence permits, and national insurance numbers. While most UK adults possess at least one of these forms of ID, a small yet notable minority—often the most vulnerable—do not.

–

The government’s rationale for a universal digital ID is that it would eliminate ambiguity and standardise right-to-work checks. However, this overlooks the utility of existing IDs for the vast majority and the administrative burden on those without any such documentation.

–

Passports and driving licences already function as widely accepted photo IDs, but they come with their own barriers: the cost of obtaining or renewing them can be prohibitive for low-income individuals, and not everyone drives or travels abroad. National insurance numbers, meanwhile, are essential for employment but currently lack a photo or biometric component, which limits their utility as a standalone proof of identity.

–

Financial and Administrative Costs

–

Implementing a new, mandatory identity system is no trivial expense. Previous government estimates for similar schemes, such as the scrapped ID card project of the 2000s, ran into billions of pounds. Even with advances in digital technology, initial outlays for infrastructure, IT systems, and public outreach would be substantial. Ongoing maintenance, cybersecurity, and support for those struggling with digital access would further increase costs. It is likely that the taxpayer would bear the brunt of these expenses, raising questions about value for money in a period of fiscal restraint.

–

There are also indirect costs to consider: employers would need to update recruitment processes, train staff, and potentially invest in new verification technology. For individuals, especially those unfamiliar with digital systems, navigating registration could prove daunting.

–

Implementation and Effectiveness: Will the BRIT Card Work?

–

The effectiveness of the BRIT Card hinges on comprehensive registration and consistent enforcement. Everyone of working age—citizens and migrants alike—would need to register, provide biometric data, and keep their details up to date. Yet, experience with government digital projects suggests that achieving universal compliance is highly challenging. Those liable to work illegally may simply avoid the system or find ways to circumvent it, such as using forged documents or working in the informal economy.

–

Moreover, determined employers who currently flout right-to-work checks may be equally adept at sidestepping a new ID regime. The deterrent effect, therefore, risks being limited unless accompanied by a step-change in enforcement resources and penalties.

–

Privacy, Digital Exclusion, and Data Security Concerns

Centralising sensitive personal data in a single digital ID system raises profound privacy risks. The more data collected—biometric, personal, employment—the greater the consequences if that data is breached. Past incidents, both in the UK and abroad, demonstrate that no system is immune to hacking or accidental leaks.

–

Digital exclusion is another pressing issue. Significant numbers of people—especially older adults, those with disabilities, or individuals lacking internet access—could struggle to register or maintain their digital ID. Ensuring equitable access would require costly support services and alternative registration methods, potentially undermining the efficiency arguments for a digital-first approach.

–

Finally, there is the risk of ‘scope creep’: once a digital ID exists, the temptation to use it for other purposes—such as accessing public services, policing, or even voting—may grow, raising further civil liberties concerns.

–

Comparison to Existing Laws and Penalties

UK employers are already legally obliged to check employees’ right to work, with substantial fines and potential criminal sanctions for non-compliance. The Home Office provides guidance and maintains a list of acceptable documents. While enforcement is sometimes criticised as patchy, the legislative framework is well-established. The BRIT Card, therefore, represents a new administrative layer rather than a fundamental legal shift.

–

Crucially, the existing system allows for a degree of flexibility that could be lost with a rigid, one-size-fits-all digital ID requirement. For those with complex or unusual immigration circumstances, or those whose documents are in the process of being renewed, this could create real hardship.

–

An Alternative: Enhancing the National Insurance System and Targeted Enforcement

–

Rather than create an entirely new identity infrastructure, a more proportionate solution could involve modernising the existing national insurance (NI) system. By incorporating a secure photo ID or biometric element into NI numbers, the government could strengthen right-to-work checks without duplicating documentation requirements. Such an enhancement would leverage a system already embedded in the employment process and familiar to employers and workers alike.

–

This approach should be paired with targeted, intelligence-led enforcement focusing on high-risk sectors and repeat offenders, instead of blanket bureaucracy. Investment in digital verification tools for employers and regular audits would further bolster compliance, while avoiding the pitfalls of a universal digital ID.

–

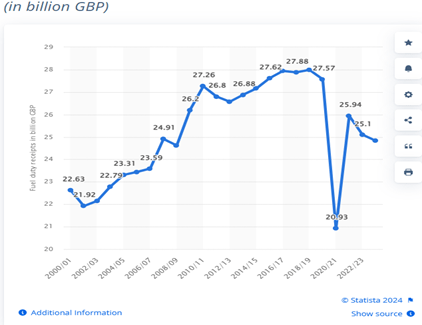

What would this cost. Well, I would set up a task force of 400 HMRC investigators to chase down illegal workers which I estimate would cost £30million. Both the individual and the employer would be fined. If they only found 5 illegal worker each and the employer was fines £15000 (the current law allows up to £45k for the first offence), this would cover the cost. However, since it is suggested, there are over 500,000 illegal workers in the UK, there is a potential of £22 Billion to recover.

–

I personally would start the fine at £10,000 for businesses and £2500 for individuals. The reason for this is the smaller business would go out of business with a £45k fine, but £10k should be enough of a deterrent. Remember, both the employer and the employee are doing something illegal.

–

Those foreign nationals without any right to stay would be sent home.

Personal Perspective: A Flawed Solution in Search of a Problem?

–

Labour’s BRIT Card proposal appears to be a politically expedient response to anxiety over immigration and illegal working. However, the costs—financial, administrative, and personal—seem disproportionate to the likely benefits. The risks to privacy and the spectre of digital exclusion cannot be ignored, especially when existing systems can be strengthened at lower cost and with less disruption.

–

Public trust in government data handling is already fragile, and the creation of a new, centralised identity database risks eroding it further. Rather than pursue a grand new scheme, the government would do better to focus on pragmatic reforms to the national insurance system and smarter, more targeted enforcement.

Leave a comment