Introduction

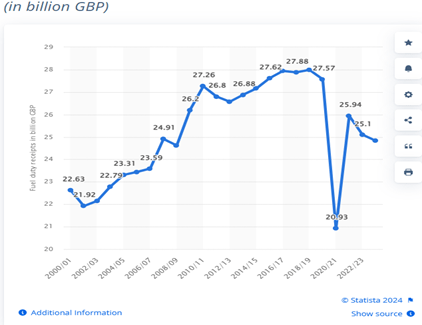

Over the past five years, the UK Government has witnessed a significant reduction in fuel duty revenue together with a decline in car BIK (Benefit in kind) revenue.

The loss over the last 5 years is circa 3 Bn per year for fuel duty alone.

–

This decline can be attributed to the increasing adoption of electric vehicles (EVs), which do not attract fuel duty. So the revenue from fuel duty is only going to decrease as more and more people shift to Electric Cars.

–

The Decline in Fuel Duty Revenue

Fuel duty has historically been a significant source of revenue for the UK government. However, in recent years, this revenue has been on a steady decline. Fuel duties, which once contributed as much as 8% to the annual tax revenues, have now dropped to around 4% over the last four fiscal years . it will decrease further over the coming years.

–

The Rise of Electric Vehicles

The adoption of electric vehicles in the UK has been growing rapidly. In 2023, the number of electric cars registered in the UK reached 455,200, a 23% increase from the previous year . By the end of June 2025, there were over 1.55 million fully electric cars on UK roads .

–

Whilst the government has started to address the shortfall, I do not think it is sufficient to fill the gap and is therefore adding more pressures on other taxes and government expenditure.

–

Cost Comparison: Public Charging vs. Home Charging

–

There are 3 factors that affect the adoption of Electric Vehicles

–

Firstly, no road funds licence. Whilst the government has introduced a modest fee, this is not in my mind sufficient to offset the loss in revenue.

–

The second factor that is influencing the adoption of electric vehicles is the cost of charging. Charging an electric vehicle at home is generally more cost-effective than using public charging stations. The average cost of electricity in the UK is around 34p per kWh, (I pay 25p per Kwh) making home charging significantly cheaper. In contrast, public charging stations can cost around 50p per kWh for fast charging and up to 73p per kWh for ultra-rapid charging .

–

These figure are interesting when you compare to the wholesale electricity currently cost of 8.69p per Kwh. (according to Energy Stats UK). Assuming 70p per Kwh, at the charging point, 20% VAT 12p less 9p wholesale cost, this gives 49p to the supplier. However, at home at a charge of 25p per Kwh (what I am currently paying for electricity) and VAT at 5% (1.25p per Kwh) the supplier gets 14.75p per Kwh.

–

My conclusion is that, the supplier for a service station charges are getting over triple that your domestic supplier is getting, which does not make sense to me. I believe that the charges at the service station charges are charging a rate compatible with Petrol and Diesel costs, even though they are heavily taxed. The charger providers are making the equivalent to the fuel duty on the petrol and diesel that would otherwise go to the government. They are doing this because they can and people will pay as there is not enough competition due to lack of charging points.

–

I accept that there is a capital expense in installing a charging station, but no more so than a petrol station, so why should they make significantly more money.

–

Thirdly, the benefit in kind (BIK) for electric company cars is ridiculously low. Currently the BIK is now 3% which means someone with a £40,000 company car in the 20% tax bracket would only pay £20 per month. That is one hell of a benefit and does not reflect the actual benefit. To lease an equivalent car would be over £300 per month. So it is no wonder 50% of company cars are now electric.

–

So What would I do

- Have all cars subject to a minimum road tax of £195 as current level.

- I would have a sliding scale for cars based upon their power. It is the way they tax ICE (Internal Combustion Engines) cars so this should be applied to Electric Vehicles. In essence a car that can accelerate from 0-60 in under 4 seconds will use more electricity than a car that achieved it in 8 seconds. You can even buy a small Volvo SUV that can accelerate from 0-60 in 3.6 seconds. This is ridiculous. The sliding scale I would implement would be £100 per second under 8 seconds. Given the average mainstream EV acceleration is under 6 seconds, this would generate £2.2 bn to £3Bn

- I would also adjust the BIK (benefit in Kind) for company electric cars. I would charge a BIK that is the equivalent tax of £100 for 20% tax payers and £200 for higher rate taxpayers. This would add at least ½ Bn to 1Bn in tax revenue.

- I would add 20% charge for the equivalent of fuel duty. Whilst in theory, this would increase the cost by 20%, I believe by increased competition as more charging station appear, this cost will be absorbed into the overall cost. As I explained earlier, the current suppliers are making too much. I believe this would generate 0.25 Bn

- I would have the equivalent of Ofgem, to monitor these costs and if necessary, implement a price cap. It works for our domestic supply so why not for Car charging.

- The above would apply to all cars, EV or ICE and would rectify the decline in revenues from Fuel Duty etc due to electric Vehicle. However, I would make electric vehicles subject to 10% VAT and Hybrid subject to 15% VAT producing a £4000 saving on a New £40k EV. How would this be paid for? I expect this to pay for itself as it will encourage additional purchases of New EV’s, in significant higher numbers than before. I would go further and reduce UK made EV cars to 5% VAT to encourage investment in the UK. I have, whenever possible bought (8 out of the last 9 cars) British Made cars and anything that encourages home grown products has to be a good thing.

Conclusion

The reduction in fuel duty revenue, coupled with the rise of electric vehicles, presents a significant challenge for the UK government. While the transition to electric vehicles is essential for environmental sustainability, it also necessitates a re-evaluation of the tax system to ensure that government revenue remains stable.

Leave a comment